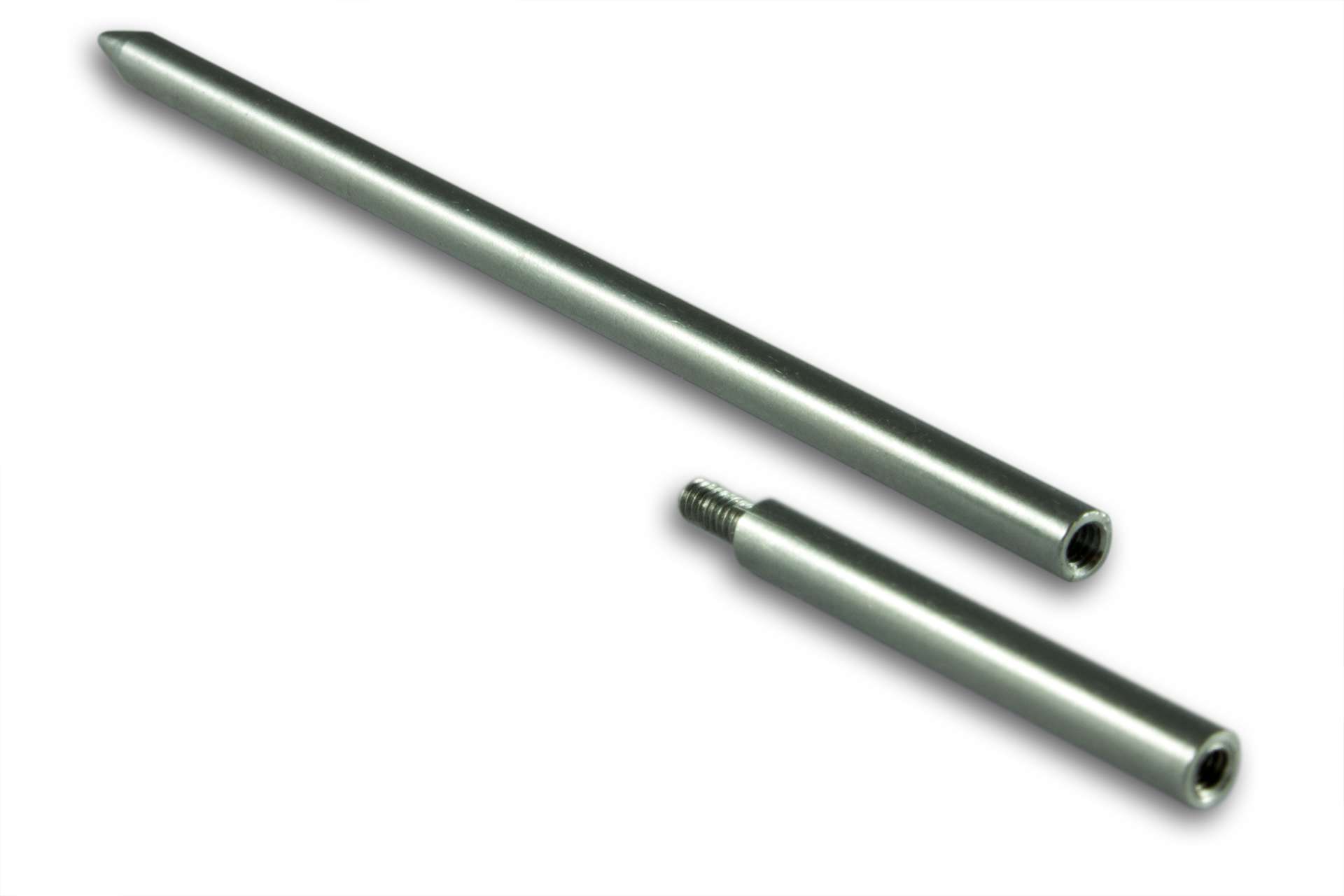

Paracord Nadel Edelstahl für 4mm Band gerade lang 127mm 1Stk. | Perlenundmehr.at - Österreichs größter Perlen Online-Shop

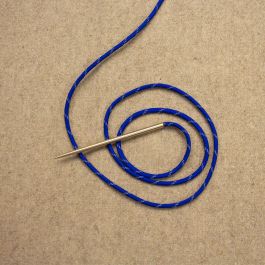

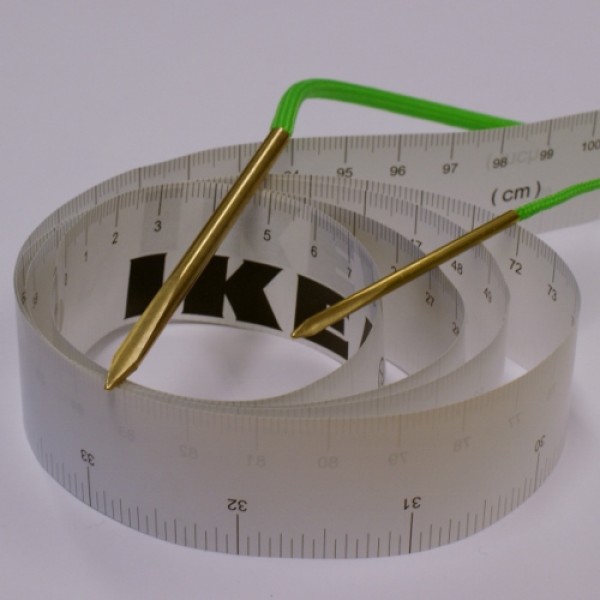

Ganzoo Paracord Nadel, Edelstahl Strick-Nadel für Paracord 550 Seile, 5 mm Flecht-Nadel : Amazon.de: Küche, Haushalt & Wohnen

Ganzoo Paracord Nadel im 2er Set, Edelstahl Strick-Nadel für Paracord 550 Seile, 5 mm Flecht-Nadel : Amazon.de: Sport & Freizeit