PEARL Ordnungsboxen mit Deckel: 4er-Set kleine Aufbewahrungsboxen mit Deckel, faltbar, 25 x 15 x 15 cm (Faltboxen)

BELIOF 5 Stück Pearl Aufbewahrungsbox mit Fächern Schmuck Schließfach Kunststoffbox mit 15 Gittern zur Aufnahme von Glitzer-Strasssteinen Schraube Fischfutter Kleines Werkzeug (3 Weiß + 2 Blau) : Amazon.de: Küche, Haushalt & Wohnen

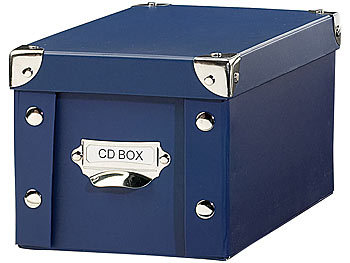

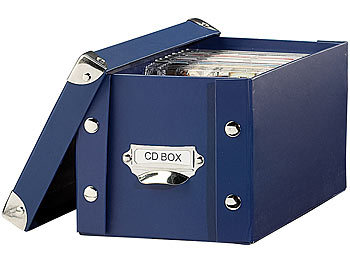

PEARL CD Archivbox: CD-Archiv-Box für 24 Standard- oder 48 Slim-CD-Hüllen, blau (CD Aufbewahrungsbox)

PEARL Faltbox mit Deckel: 2er-Set Aufbewahrungsboxen mit Deckel, faltbar, 31x31x31 cm, weiß (Ordnungsbox)

PEARL Faltbox mit Deckel: 2er-Set Aufbewahrungsboxen mit Deckel, faltbar, 31x31x31 cm, weiß (Ordnungsbox)

TERRA SELL Hochwertige Aufbewahrungsbox mit Deckel aus Stoff zum Falten/Ordnungsbox/Sortierbox/Faltboxen im 2er-Set 32 x 32 x 15 cm (grau) : Amazon.de: Küche, Haushalt & Wohnen

PEARL Ordnungsboxen mit Deckel: 4er-Set kleine Aufbewahrungsboxen mit Deckel, faltbar, 25 x 15 x 15 cm (Faltboxen)

PEARL Faltbox: 2er-Set Aufbewahrungsboxen mit Deckel, faltbar, 31x31x31 cm, schwarz (Faltbare Box mit Deckel)

PEARL Masken Box: 16er-Set Masken-Aufbewahrungs-Etuis, staubdicht und hygienisch, bunt (Masken-Etui)

PEARL Faltbox: 2er-Set Aufbewahrungsboxen mit Deckel, faltbar, 31x31x31 cm, schwarz (Faltbare Box mit Deckel)

infactory Sitz-Aufbewahrungsbox: 2er-Set faltbare 2in1-Sitzbänke und -truhen, 80 l, bis 300 kg, schwarz (Aufbewahrungsbox mit Deckel)

PEARL | 2in1 Solar-Campingleuchte CL-103.ms, Aufbewahrungsbox, 100 lm, blau - Ihr Elektronik-Versand in der Schweiz

infactory Sitzbox: Faltbare 2in1-Sitzbank und -truhe, 80 l, bis 300 kg, Kunstleder, weiß (Faltbare Sitzbox)

PEARL CD Archivbox: CD-Archiv-Box für 24 Standard- oder 48 Slim-CD-Hüllen, blau (CD Aufbewahrungsbox)

PEARL Faltbox mit Deckel: 2er-Set Aufbewahrungsboxen mit Deckel, faltbar, 31x31x31 cm, weiß (Ordnungsbox)

PEARL Ordnungsboxen mit Deckel: 4er-Set kleine Aufbewahrungsboxen mit Deckel, faltbar, 25 x 15 x 15 cm (Faltboxen)

YANROO Make-up Pinselhalter Organizer mit Deckel Kosmetikpinsel Aufbewahrung Enthält Pearl Desktop Aufbewahrungsbox Stifthalter, Make-up Pinsel, Eyeliner, Lippenstift usw. (weiße Perle) : Amazon.de: Beauty

PEARL Faltbox mit Deckel: 2er-Set Aufbewahrungsboxen mit Deckel, faltbar, 31x31x31 cm, weiß (Ordnungsbox)