AideTek ESD Safe SMD Storage IC Box Bins Anti-statics SMT Organizer Transistor Electronics Storage Cases & Organizers BOXALLAS

Amazon.com : AideTek BOXALL144 ESD Safe SMD Resistor IC Chips Organizer w/144 Bins antistatics : Office Products

ESD Tote Box Covers: Heavy Duty Snap-On, Black, Conductive, Fits LB-DC1000 Boxes, 12/Case, Price Per Case, LB-CDC1040-XL - Cleanroom World

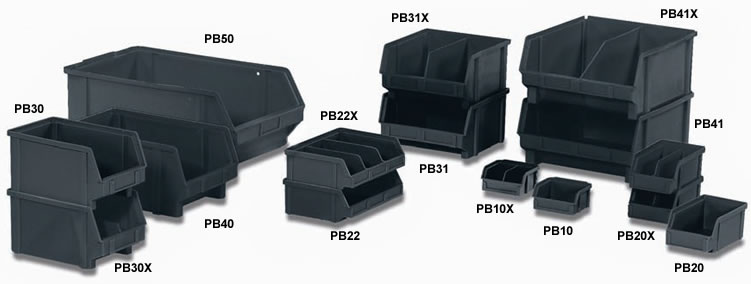

Amazon.com: Akro-Mils 30210 AkroBins ESD Electrostatic Dissipative Anti-Static Stack and Hang Storage Bins, (5-Inch x 4-Inch x 3-Inch), Black, (24-Pack) (30210ESD) : Everything Else

.jpg)