Amazon.de: Led Hinterleuchteter Badspiegel Nova Spiegel in 5mm Stärke mit Beleuchtung Wandspiegel Lichtspiegel (120 x 80 cm, Warm)

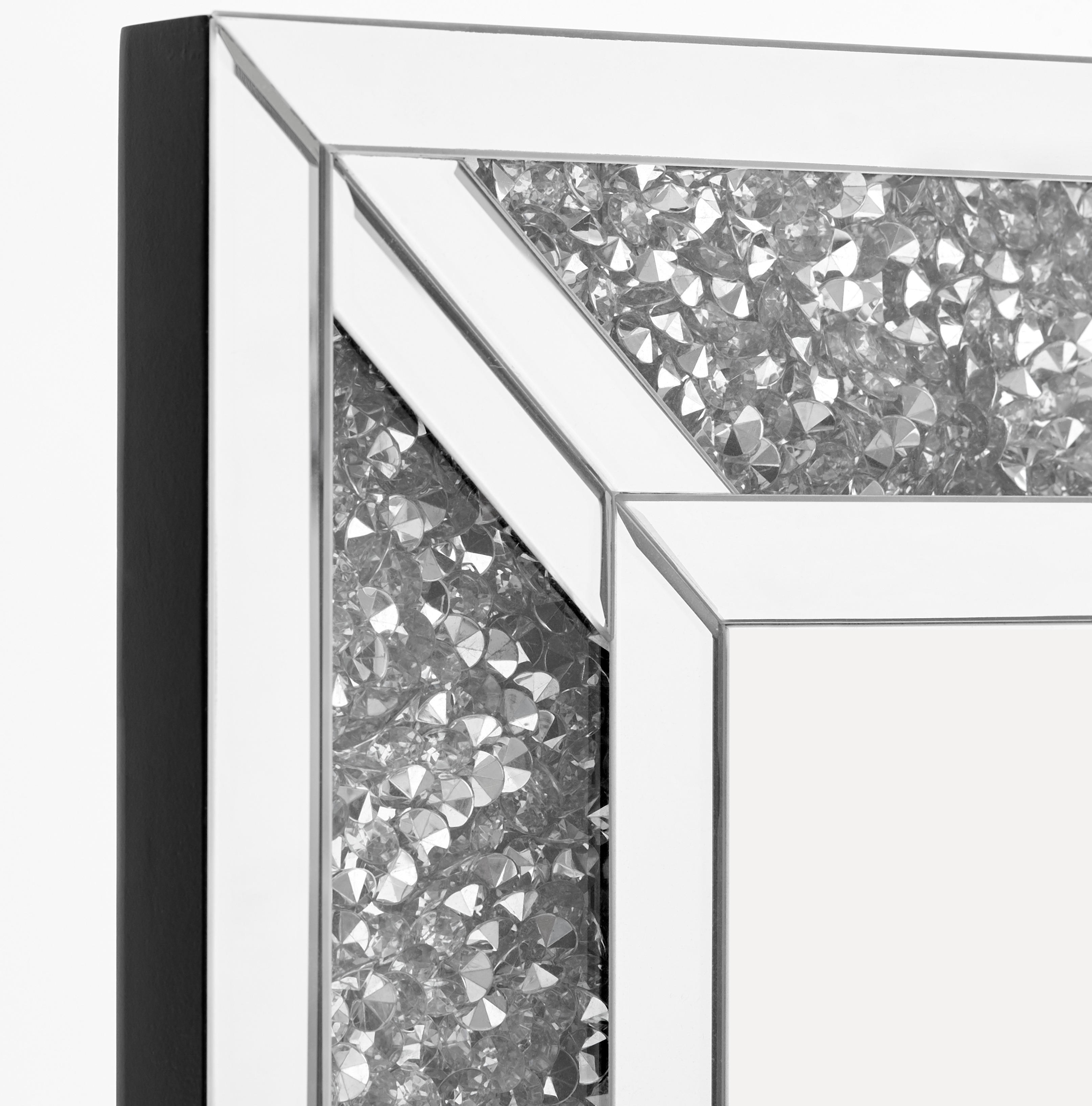

LC Home Wandspiegel Barock Spiegel Silber ca. 120x90 cm Antik-Stil Flurspiegel Doppelrahmen Facettenschliff

Casa Padrino Luxus Spiegel Silber Ø 120 cm - Runder Glasfaser Wandspiegel - Wohnzimmer Spiegel - Garderoben Spiegel - Luxus Kollektion | Casa Padrino

Casa Padrino Barockspiegel Barock Spiegel Silber 91 x H. 120 cm - Prunkvoller Wandspiegel mit Holzrahmen und wunderschönen Verzierungen

LC Home Wandspiegel Barock Spiegel Silber ca. 120x90 cm Antik-Stil Flurspiegel Doppelrahmen Facettenschliff